If you expect to owe $1,000 or more in taxes, you’ll be expected to make IRS payments. As a result, their adjusted gross income would go to $42,500, putting them in the 12% tax bracket, and they would end up paying less in taxes.Īs someone self-employed, your income isn’t withheld from an employer, and you’ll need to make estimated tax payments quarterly on your income.

US FEDERAL TAX BRACKETS 2020 FULL

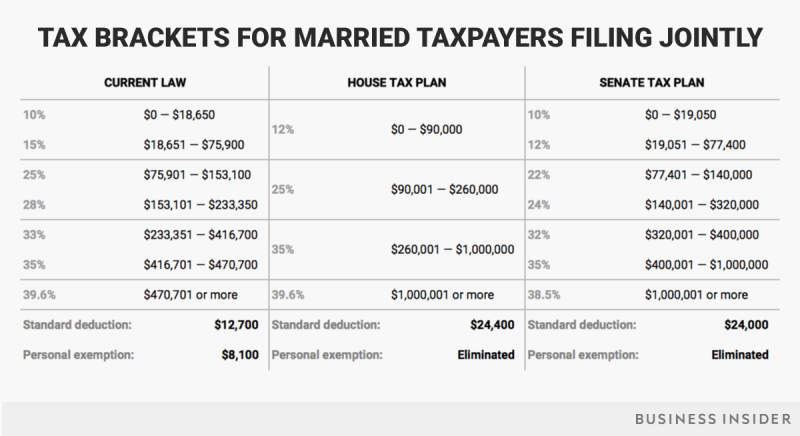

If they qualified for the American opportunity credit and received the full $2,500 tax credit for expenses such as tuition and books, the credit would be able to lower their income by that amount. If they earned $45,000 in adjusted gross income, they would just barely be in the 22% federal tax bracket for 2023. Tax credits can be very helpful for students, for example, who might be working a freelance job while getting an undergraduate degree. What is taxable income? Also known as adjusted gross income, this is the amount of income before any tax is applied and after all deductions and tax credits have been taken. Deductions and tax credits to lower your taxable income, and there are many different tax deductions and credits, like the food and entertainment deduction, subscription-related tax deductions and the education tax credit. One of the best ways to get your income into a lower tax bracket is by taking self-employment tax deductions. It’s taxed at 10%, which means the first $10,275 of the money you made that year is taxed at 10%. The lowest 2022 tax bracket, or the lowest income level, is $0 to $10,275. The IRS has set seven tax brackets 2022 taxpayers will fall into. With the Tax Cuts and Jobs Act, the IRS set the tax rates at 10%, 12%, 22%, 24%, 32%, 35% and 37%. The higher your annual adjusted income is, the higher in general your marginal tax rate will be The tax rate charged on the first dollar you earn at the start of the year will likely be far lower than the tax rate charged on the last dollar you earn in the year. The last dollar of income you’ve earned in the highest tax bracket that is referred to as your marginal tax rate. Parts of your income might fall into different tax brackets than other parts. With every payment you receive from working, you’ll reach a different bracket as your overall income increases. With a marginal tax rate system, taxpayers are divided into tax brackets, and their income is taxed based on their tax bracket. Typically, the IRS adjusts the rates each year due to rising inflation costs. The income tax bracket system, also known as the progressive tax system, is the IRS' attempt to make the American taxation system have the same impact on taxpayers at every income level. One way to get your income to a lower tax bracket is by taking tax credits and deductions.

0 kommentar(er)

0 kommentar(er)